GL Posting Report

GL DISTRIBUTION REPORT & POST

PURPOSE:

This program was designed to run, in conjunction with our accounting package. When this is done, the appropriate accounting entries will be generated. The setup information in this file assumes that you have KLM Software's accounting package. When running the Payroll System alone, ignore all references to journal records and transfer of data.

The payroll and accounting sections of this package are separate entities, this option must be run before any information created in the payroll section will be posted to the accounting.

In a manual system, you would have to record the employees wages as expenses, government deductions as liabilities and pay cheque amounts as deductions to the bank.

KEEP IN MIND

Before you can run this option, you must have the following files in place:

- A valid COMPANY MASTER record in Menu #1.

- Valid GL ACCOUNT Master file in ACCMENU #2 (if you have a KLM Accounting package).

- Valid EMPLOYEE MASTER records in Menu #5.

- Valid Pay Codes File in Menu #8.

- Valid Posting Table in Menu #6 (a default posting table is provided).

- Existing Earnings History Records in Menu #9

Successfully completion of this menu option will produce the following information:

- Payroll Post Summary Report

- GL Detail Journal Records (for KLM Accounting)

- List of Pay Cheques Issued - optional

- List of Error Records - optional

This option can be run at a later time, however to avoid any confusion, we recommend that you run this report immediately after the Cheque Register is completed.

TO PROCESS A PAYROLL

The steps that follow represent the standard routine for posting a payroll in order to produce detail journal records and the GL Posting Summary Report.

BEFORE PROCESSING THE PAY INPUT

Perform the following routine before posting payroll:

1) If you have our Accounting packages, do a backup of the Accounting Data. While this is optional, it is also recommended.

2) Make sure that any changes to your payroll for the weeks to be posted, have already been made.

DURING POSTING OF THE PAYROLL

To post your payroll records to the accounting journal and produce the posting report.

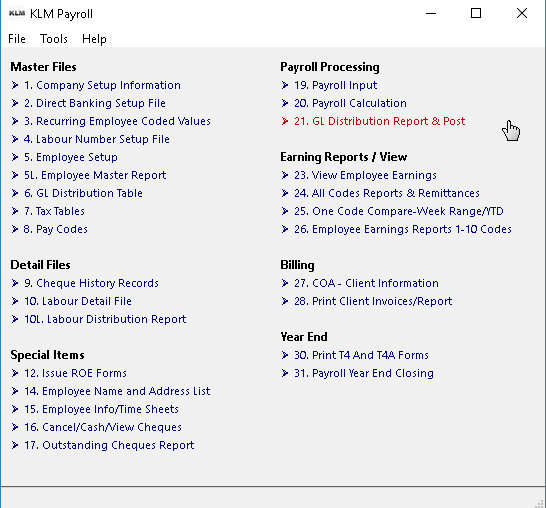

1) From the KLM Payroll System Selection Menu, click on GL Distribution Report & Post. The appropriate report screen will be displayed.

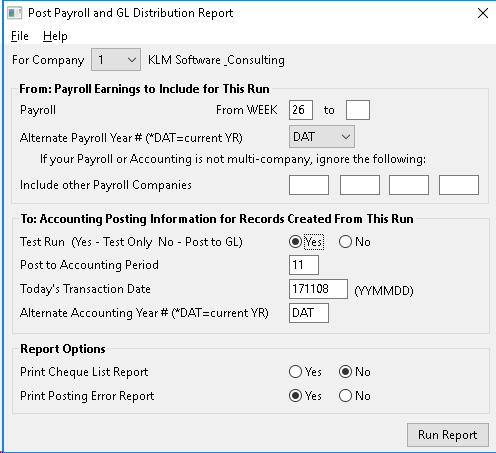

2) The Post Payroll/GL Distribution Screen is divided into 3 areas: Payroll Earnings To Include, Accounting Posting Information and Report Options. By answering various prompts, you can limit the amount of data (such as week range) to be posted to the accounting system. Read the prompts carefully before answering them.

3) Once all prompts have been answered, click one on the RUN REPORT Button. A Print Preview Window will appear. Review the report, than send it to the printer of your choice. NOTE: While not necessary, it is advised that you do a TEST RUN first, before posting, so that errors can be easily fixed.

Once run, ALL employee earnings records for the pay week range will be read and ONE journal record will be created for each GL Account identified in the Posting Table. The ONE exception being the bank entry. Identified by N (NET Pay) pay code as separate journal entry.

The Payroll Posting Summary Report, provides a hard copy of the newly created GL records. If several entries are printed for the same GL Account, a subtotal is printed for that account.

The only limits to what is selected are the **WEEK range ** and FILE name. Re-running this option, for missed records will result in ALL records, being reproduced.

Out-of-balance situations, MUST be corrected or the accounting journals will be out-of-balance as well. If the FINAL TOTAL of the Posting Report balances to ZERO, the run was a success. Any other figure will proceeded by an error report.

AFTER POSTING THE PAYROLL TO THE GL JOURNAL

After you posted your payroll (run this menu option), perform the following routine:

1) Look for errors such as rejected records and/or the TOTAL BALANCE figure NOT showing as ZERO.

2) If all figures are valid, post the newly created journal records using the Post & Link Journal Details Menu in our Accounting package. Be sure to verify that the records posted correctly to the accounting program.

3) Do a DATA backup of the NEWLY created Accounting entries. This is optional but is recommended as you have added new journal records to the accounting journal.

REPORT PROMPTS - DEFINITIONS

Remember to fill in ONLY those prompts that apply to your situation. If you do not have KLM Accounting software bypass the Accounting section of the selections menu.

DATA LIMITS

FOR COMPANY: You must choose for which Accounting company to post your payroll to. The program defaults Company 1 (one). Use the Pull Down Menu to select an alternate company.

For the posting routine to work the company you select must have VALID master files or the program will not create proper report or post any accounting journal records to the correct place.

PAYROLL EARNINGS TO INCLUDE...

The Payroll Earnings To Include section requires the following prompts to be filled in before the GL Distribution Summary Report will begin.....

From WEEK TO WEEK: In these 2 prompts, you must indicate the week range to use for selection of payroll records. Only earnings records in this range will be selected and posted to the accounting section.

ALTERNATE PAYROLL YEAR: leave the default of DAT in place unless you need to select payroll records for a year other than current.

INCLUDE OTHER PAY COMPANIES: Should be left **BLANK **unless you have more than one payroll company and you want payroll records for said companies posted to the company referred to earlier.

ACCOUNTING POSTING INFORMATION

The Accounting Posting Information section requires the filling in of the following prompts before the program will create detail journal entries in our accounting program.

TEST RUN (YES / NO): By selecting either YES or NO (by clicking on the correct radio button), you will determine whether or actual detail journal records are to be created. If YES, test is done, a report will still print but no journal records will be created. You can run as many tests as need be without any actual changes being made.

POST TO ACCOUNTING PERIOD: Defaults to the current accounting period, change this prompt, only it the journal records generated by this option should be applied to another accounting period.

TODAY'S TRANSACTION DATE: Defaults to the computer generated system date.

ALTERNATE ACCOUNTING YEAR: Leave the default of DAT in place unless you plan to send your newly created journal records to an accounting year other than the current year.

REPORTING OPTIONS

The Report Options Section requires the filling in of the following prompts before the program will print these reports. The printing of these lists will have no effect on the main functions of this menu option. The program will automatically produce an "error" report if the Posting report is out of balance.

PRINT CHEQUE LIST REPORT: Does not normally print, unless you select YES. When run this report gives you a list of ALL Pay Cheques issued for the pay week range specified. If selected this report will print BEFORE the GL Distribution Summary Report.

PRINT POSTING ERROR REPORT: Is normally printed, unless you change the prompt to NO. This report lists any earnings records that are out of balance. This report appears ONLY if there are errors. The details from each error record are listed (including the amount the record is out by). This report prints before the GL Distribution Summary Report.KLM RECOMMENDS THAT YOU ALWAYS PRINT THIS REPORT.