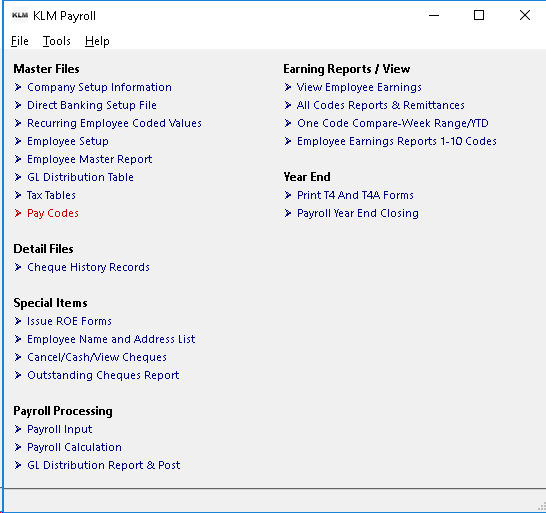

Pay Code Setup

PAY CODES

PURPOSE:

This file is supplied by KLM, with a unique one available for each province. In most cases this file is shared by all companies. In the Company Master record, the Pay Codes field is used to indicate which of the available pay code files is accessed when you selected the company number upon first access of this program.

The pay code records, defined in this file, act as A BLUE PRINT FOR HOW, WHEN AND WHAT PAYROLL VALUES WILL BE USED by this system. It holds the letter ID (PAY CODE) and particulars that define the earnings, benefits, deductions, and accumulations involved in the calculation and reporting of your payroll.

This file is also responsible for the functions:

* All pay calculations and the order in which they are done.

* How a pay value is evaluated; i.e. whether the amount is treated as a deduction, earning etc.

* What descriptions and amounts will be printed on cheque stubs and deposit slips.

* What amounts will be accumulated (stored) in the employee earnings history.

Pay code X Y y R O H G C Q U I T N are reserved for special values and functions by programs like the T4 and Record of Employment.

WARNING

Any changes to this file will directly affect the calculation of the payroll and if not done properly can result in MAJOR PROBLEMS with invalid amounts being applied to a pay. With our guidance, changes can be made to this file to CUSTOMIZE this system to your unique needs, resulting in greater flexibility and time savings.

Before changes are made, you should clear them with KLM to make sure the changes will not have a negative affect on the system.

The first Pay Calculation Run after any change MUST be monitored for any possible errors caused by the misapplication of the change(s).

This file is altered by means of an update program sent to you in response to government changes to standard deductions in income tax, Canada/Quebec pension and Employment Insurance. KLM Software provides this service, for a yearly maintenance fee. Contact KLM Software for further information.

ADD A NEW PAY CODE

Before you add a new Pay Code Record, first make sure you have an available unused letter, number or special character to use.

Keep in mind that upper and lower case letters are considered different. As a rule, letters should be used as main earnings, benefits, deductions and accumulations. Numbers are used as report time totals and special characters are used by KLM to define needed sub calculation steps.

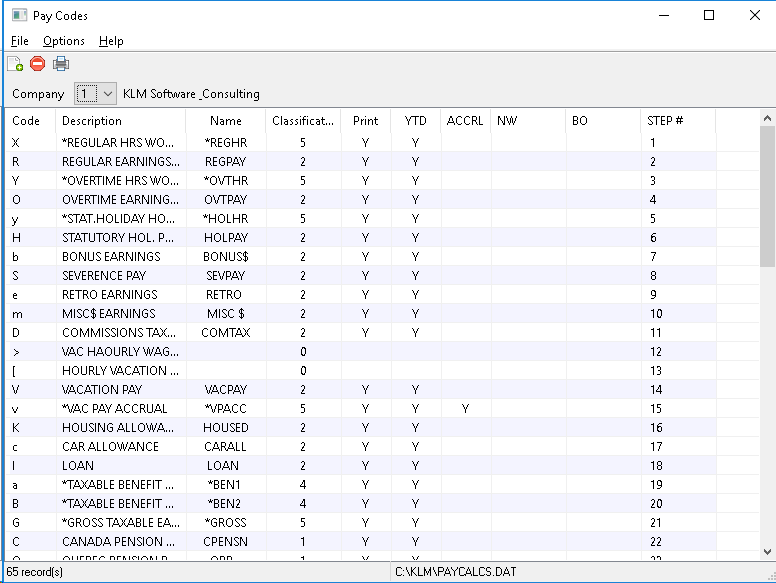

- Upon entering this option you will be give a list of all PAY CODE records in this file. As it is possible to have multiple files (one for each active company) make sure the COMPANY Number is correct (the program always defaults to Co. 1). Change the company if necessary than continue.

- To add a NEW record to this file, go to the MENU Bar (top left of your screen) and click on FILE. Then select NEW from the Pull Down Menu. You can also use the NEW Icon in the Task Bar (under the Menu Bar) to add a record.

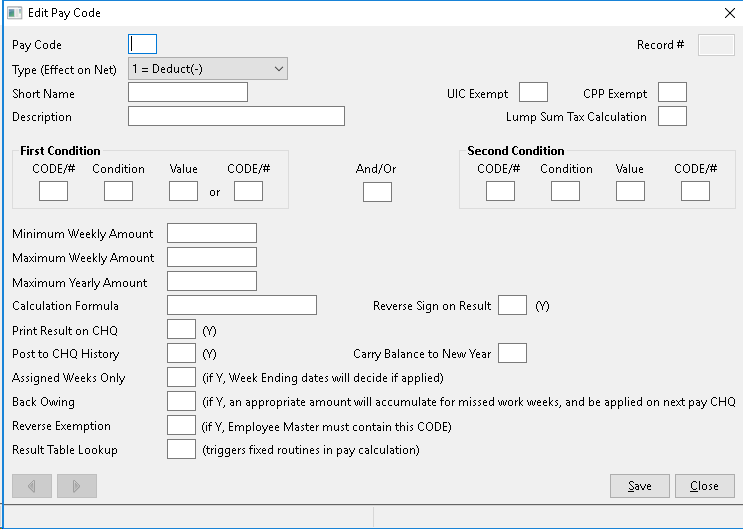

- A BLANK record EDIT screen will appear. Fill in the appropriate fields (see Field Definitions below) then SAVE the record using the SAVE Button (bottom right of current screen). The NEW record will be displayed as part of the main list.

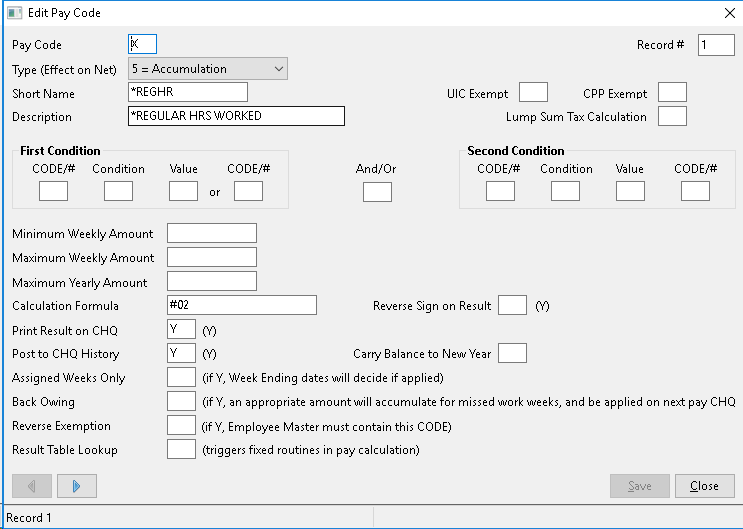

UPDATE AN EXISTING PAY CODE

If you are not sure what the code is, use the listing that appears upon entry to this option.

- Find the record, move the pointer to the record then click once to select. The PAY CODE record will be displayed ready for update.

- Make your changes, then SAVE the record using the SAVE Button.

PRINT A REPORT

Upon entering this option, you can print a hard copy of the this file, by going to the MENU Bar (top left of your screen) and clicking on the FILE option. Select PRINT from the Pull Down Menu. A standard Windows Print Setup screen will appear. Select your printer then click on OK to begin.

FIELD EXPLANATIONS

FIELD NAME |

DEFINITION |

PAY CODE |

A Pay Code MUST be unique compared with other CODES, a letter (upper or lower case), number or special character. This character** is the key reference which will be stored along side its value in each earnings record. |

RECORD# |

This number represents the sequence relative to other calculation steps and is the actual record number (position) in the file. Changing the RECORD# will change the position of the record within this file. All new records are positioned at the end of the file. When adding new records, you MUST know where other pay codes of the same type are stored within the file (i.e. other deductions), then change the record number accordingly. |

TYPE |

This field identifies the type of value applied to this code and also controls how this value will affect the Net Pay during the cheque calculation PAY#20. VALID TYPES and the affect on NET Pay are; 0 Used in calculation steps, no affect on Net. 1 Deduction value, reduces Net. 2 Taxable Earnings, increases Net. 3 Non-Taxable Earnings, increases Net. 4 Taxable Benefit, no affect on Net. 5 Accumulator (i.e. hours worked), no affect on Net. 6 Report Time Total, no effect on Net. |

SHORT NAME |

Enter a unique short name to be used as a description for this PAY CODE on screens, reports, cheque stubs and anywhere space for the full description is not available. |

UIC EXEMPT |

Valid for Type 2, 3 and 4 only. If a code has a Y in this field, its value will be exempt from any EIC calculations during the Calculate & Issue Pay Cheques (MENU #20). Only Revenue Canada approved values can contain a Y in this field. |

CPP EXEMPT |

Same as the above field, except it will affect CPP/QPP calculations instead of EIC calculation. |

DESCRIPTION |

Enter a unique description to identify this Pay CODE on any report where room is available. |

First CODE/# |

Enter either a valid Pay CODE (one that already exists in this file) or a preset program variable. Program VARIABLES are represented by two digit numbers preceded by a # (i.e. #36=Employee department number). A list of these VARIABLES can be obtained from KLM) |

First CONDITION |

Enter a value two character code that represents the way in which the CODE/# will be compared to the VALUE or CODE/# fields. Valid entries are: EQ for Equal To, NE for Not Equal To, GT for Greater Than, GE for Greater Than or Equal To, LT for Less Than and LE for Less Than or Equal To. |

First VALUE |

Enter a numeric value. If left blank, the field that follows MUST be filled in. |

First CODE/# |

Enter either a Valid Pay CODE or preset variable. This field CAN NOT be filled in, if the previous field was filled in. |

AND/OR |

Enter an A if both 1st and 2nd conditions MUST be met, in order for the step to be performed. Enter an O if **either the 1st or 2nd **condition MUST be met, in order to perform the step. |

Second CODE/# |

Enter either a valid Pay CODE (one that already exists in this file) or a preset program variable. Program VARIABLES are represented by two digit numbers preceded by a # (i.e. #36=Employee department number). A list of these VARIABLES can be obtained from KLM) |

Second CONDITION |

These fields are optional and should only be filled in if the fields for the FIRST Condition are as well. Enter a value two character code that represents the way in which the CODE/# will be compared to the VALUE or CODE/# fields. Valid entries are: EQ for Equal To, NE for Not Equal To, GT for Greater Than, GE for Greater Than or Equal To, LT for Less Than and LE for Less Than or Equal To. |

Second VALUE |

Enter a numeric value. If left blank, the field that follows MUST be filled in. |

Second CODE/# |

Enter either a Valid Pay CODE or preset variable. This field CAN NOT be filled in, if the previous field was filled in. |

MINIMUM WEEKLY AMOUNT |

Use this field to set a minimum weekly value for this Pay Code. Any calculated result associated with this code CAN NOT fall below this value. If the payroll is not weekly, this amount is multiplied by the number of weeks. If used in combination with the BACK OWING field for this step, this value will be used to accumulate amounts for weeks not worked. |

MAXIMUM WEEKLY AMOUNT |

Use this field to set a maximum weekly value for this Pay Code. Any calculated result associated with this code CAN NOT be greater than this value. If the payroll is not weekly, this amount is multiplied by the number of weeks. |

MAXIMUM YEARLY AMOUNT |

Use this field to set a maximum yearly value for this Pay Code. All calculated results associated with this code CAN NOT be greater than this value. Every time the payroll is processed, the year to-date amount is checked. It the maximum is reached, this calculation is discontinued. Note, maximums for CPP, UIC and certain TAX calculations are set by KLM Software AND SHOULD NOT be adjusted. |

CALCULATION FORMULA |

This field uses program set values, other Pay CODE values and fixed values to arrive at a result which then will be applied to this Pay CODE. If any condition associated with this entry are not met, the calculation formula is skipped. All values are separated by one of the following four standard mathematical SYMBOLS: + for add - for subtract ***** for multiply by / for divide by. The formula is processed one value at a time, from left to right. NO SPACES can be between elements of the formula. Program VARIABLES are indicated by a # followed directly by a 2 digit number discussed earlier in this section. Calculation coded values are indicated by their actualPAY CODE.Year-to-date employee amounts for a pay CODE can be accessed in a formula by an & sign followed by the desired CODE. Fixed values are indicated by an @ sign followed by a number. |

REVERSE SIGN ON RESULT |

Allows the program to change the sign of this Code's calculated result (i.e. 45.00 would be -45.00) if a Y is placed in this field. |

Print RESULT ON CHQ |

A Y in this field means the result of this Pay CODE calculations will be printed on the Pay Cheque Stub. Any item affecting an employee's pay cheque MUST be printed on their Cheque Stub or Deposit Slip. |

POST TO CHQ HISTORY |

A Y in this field will place the resulting value of this Pay Code into the Cheque History Record (Menu #9) created during the Cheque Register (Menu #20). Unless the value is stored (or saved) it will NOT be available for year-to-date figures. |

CARRY BALANCE TO NEW |

**Only applicable for TYPE=5 **accumulation pay codes. A Y in this field will cause any balance, for the year, to be applied as an adjustment to the recurring file for applicable employees, when the Payroll Year End run. The one time adjustment will be applied to the employee on the first pay pay of the new year. See Pay Code "v" Vacation Pay Accrual, for a good example of the use of this feature. |

ASSIGNED WEEKS ONLY |

A Y in this field means this CODE step will ONLY be performed if the CODE is included in the appropriate field of the WEEK ENDING DATES file (see MAIN Menu, TOOLS Menu). |

BACK OWING |

If a Y is entered in this field, the CODE for this step will be included in a special routine done during the calculation run. This routine may cause a REOCCURRING CODES file record (see Menu #3) to be entered or updated with an amount for the employees that did not work in the current pay period. The employees selected must be active and in the company selected for the payroll run and NOT exempt from this CODE. The amount back owed will depend on the MINIMUM WEEKLY AMOUNT field in this record and the WEEKLY field in any existing records in Menu #3 for this code. |

REVERSE EXEMPTION |

This works opposite of a regular exemption code, in that it allows you to isolate certain people to a calculation step formula. For the code to be activated the Employee Master file (see Menu #5) MUST have the CODE in the EXEMPTION CODES field. This code applies only on individual employees and can not be used in the COMPANY Master file (Menu #1). |

RESULT TABLE LOOKUP |

When a valid entry is made in this field, a special program routine will be activated during the step for this CODE. These routines are fixed and can only be activated by a key word. For example; the key word AX will activate a tax table search on the value of the CODE. The results of this search are placed in program set values: #07 and #08 for Federal Tax Tables, #27 and #28 for Provincial Tax Tables. |