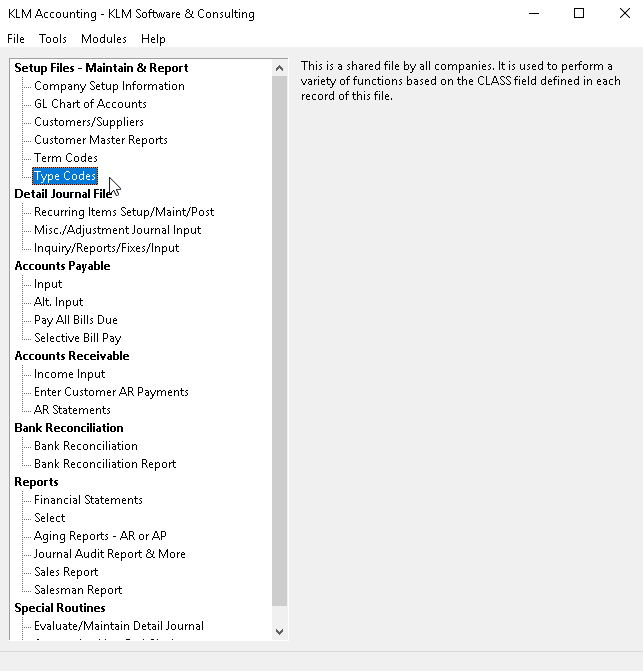

Accounting Types

TYPES CODES

This is a shared file by all companies. It is used to perform a variety of functions based on the CLASS field defined in each record of this file.

If you are using the KLM Point of Sale/Job Costing System, the functions explained here for Class "I", "P" and "S" can be done by either this file or the type file in that system. The System Control file can be altered (for both systems) to direct access to one type file or the other. (These files are called "ACCTYPES.DAT" or "INVTYPES.DAT") ACCTYPES.DAT is the default if not otherwise redirected in the control file. (ACCCNTRLW.DAT)

ADDING NEW RECORDS

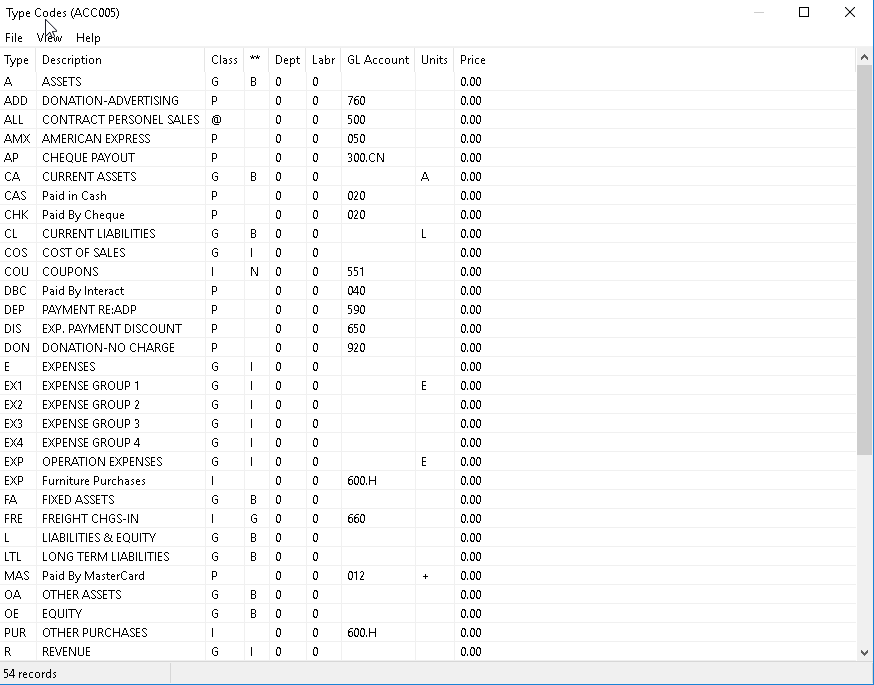

- Select the Types Code options. The first screen will be a list of ALL existing Types Code records. If this is the first time entering this option, the first screen will be blank.

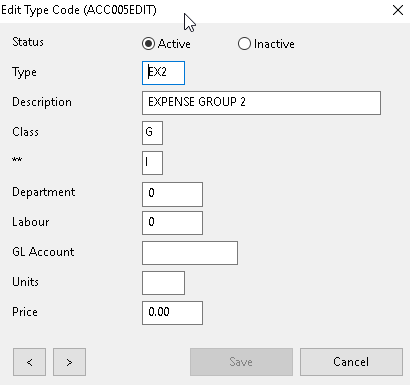

- At the VIEW select records screen, click on FILE, then select NEW. A blank EDIT Types screen will appear.

- Enter your data. To save the new record, click on the SAVE button.

MODIFY OR DELETE EXISTING RECORDS

- Select the Types Code options. The first screen will be a list of ALL existing Types Code records.

- To EDIT an existing TYPE CODE, select it by double clicking on the record in question, while in the VIEW records screen. The program will display an EDIT window.

- To DELETE any existing Type record, change the STATUS field from Active to Inactive.

- Enter changes then click on the SAVE button.

FIELD DEFINITIONS

Field |

Definition |

TYPE Code |

This code corresponds with the transaction "Type" field in other menu options and is how this file is indexed. Type codes should be unique (no two the same). Upper and lower case letters are treated as different. Both numbers and letters can be used. |

DESCRIPTION |

If NOT defined as a used field in the following CLASS definitions, this field is not used by the system. It is still a good idea to enter a description to keep the purpose of the record clear when viewing this file. |

CLASS |

Class determines the purpose of the remaining fields in the type record. Valid CLASS types are G R C I P S @. A detailed explanation of each code and it's function is provided later in this section. |

** |

One character field. It's use varies according to the CLASS filed. |

DEPARTMENT |

Used strictly with CLASS type @ (for Payroll Invoice posting). Refers to the Payroll Department. |

LABOUR NUMBER |

Used strictly with CLASS type @ (for Payroll Invoice posting). Refers to the Payroll Labour Number. |

GL ACCOUNT |

Refers to the GL Account Number (in Menu #2). The Account Number MUST be valid. |

UNIT |

Is used in several of the CLASS types. Used primarily as a unit of measure (i.e. PKG for package) in the Order Entry options. |

PRICE Will contain a dollar value. Used primarily with the Order Entry options. Depending upon the CLASS type, the dollar value will be automatically applied to Order Entry records if selected.

TYPE CLASSIFICATIONS

Below are the various CLASS Types and how each is applied within the KLM Software systems, including which fields MUST be filled in, in order for the TYPE to function properly.

"G" CLASS Records

Financial Report Headings & Categories

This kind of type is used in the "Category TYPE" of the GL Chart of Accounts Record. They indicate groupings of GL Accounts and the name to assign to the heading and total for this group when printing both the Income Statement and Balance Sheet.

DESCRIPTION

Used as a heading when printing the GL Account group associated with this type on Balance Sheets and Income Statements.

**

This field instructs the program in the GL. (when this type is entered) to place a "Y" against either the "On the Balance Sheet" or "On the Income Statement" fields. This will automatically make sure that all Accounts with this type are allocated to the proper Financial Statement. **="B" a "Y" is placed in the "On the Balance Sheet" **="I" a "Y" is placed in the "On the Income Statement"

UNITS

For G class types with **="I" only; Place an "R" in this field, to include all GL Accounts with this type, into the total used to calculate % of total on the Income Statement. ELSE Should contain a reference to another G class TYPE code that will be used for a prefix heading only if this TYPE code is the first of a related group of types.

"C" CLASS TYPE CODE Records

Currency Rates and Allowances for Exchange

These types are used to account for the exchange differences in transactions entered in currencies other than your own. If you do not account for these transactions in some way, your financial statements will be out due to different values; i.e. $100 US does not have the same value as $100 Canadian.

METHOD 1- MUST NOT fill in GL ACCOUNT or PRICE/Conversion Rate

If you do not want the system to make any allowances for for exchange differences because you have your own method of accounting for these differences then neither the Price rate or GL Account should be filled out.

You will still need to have a way of isolating out these types of transactions from the rest for reporting purposes. This can be done with special sales and expense accounts or by assigning COA#s used in these transactions to a special sub-group.

METHOD 2- Fill in Price/Conversion Rate but not GL Account

If you do not want any permanent journal records created by the system to account for currency differences but you do want the Income Statement to show in one currency. Use this method if your accountant takes care of your exchange adjustments, based on a year end average exchange rate.

This method will use the Price/Rate entered here, to convert the account total during printing of the Income Statement, for selected GL Accounts. To select which GL Accounts this is to be applied, you must enter this type into the field marked as Currency Conversion Type in the GL Account record and a "C" in the Class.

In this way, sales and expense accounts can store details in the currency they are charged but the Income Statement will show the values in your main currency for a true financial picture.

If this method is used, keep in mind, that all expenses and revenue journal entries applied to these types of accounts must be entered in their true currency.

PRICE

Enter the rate used for conversion. For example if you enter 1.45 for a US type, then $100 US will convert to $145 Canadian (100*1.45).

METHOD 3- Fill in GL Account and Price/Rate;

If you want the system to create permanent journal records to account for the exchange difference on each applicable transaction.

Applicable transactions are assigned by you when you post input after filling in the Currency TYPE field in the following programs only; POs and Order Entry.

When Evaluate Maintain Detail Journal is run, these marked records are evaluated and if applicable are used to create exchange journal records. The marker is then removed so there is no chance of duplicates being created. You have until this procedure is run to change the exchange rate (assigned in this program) and affect any exchange calculations resulting for any new records since the last time it was run.

The following journal records will be skipped for this process even if they are marked; Transaction type AR or AP or Balance Sheet GL Accounts that have a currency marked in its master record.

All exchange journal records created are assigned the type "EXC" and reflect the original details of the record they were created from (i.e. Invoice number, period, COA#, ....).

Two exchange journal records are created for each valid journal record evaluated;

- One will go to the GL Account from the record being evaluated (with the same + or - sign unless the exchange rate is negative then it will be opposite).

- The other will go to the GL Account indicated in this program against the appropriate currency type (in the opposite sign to the first entry).

"R" CLASS Records

Customizing the Bank Reconciliation Report

In the Bank Reconciliation the program normally selects positive bank journal entries for the cash receipts (+) column and the negative bank journal entries for the cash disbursements (-) column. Journal details with a transaction type like these, can be forced to display in one column or the other based on the "HTYPE" field being "-" or "+" instead of the sign on the amount.

UNITS

Enter a "+" to force all details, with this type, to print in the cash receipts column. Enter a "-" to force all details, with this type, to print in the cash disbursements column.

"@" CLASS Records

KLM PAYROLL SYSTEM Billing, Invoice Posting

Assigns GL Sales Accounts for Invoices posted from the KLM Payroll System Billing feature.

MULTIPLE @ RECORDS FOR MULTIPLE GL SALES ACCOUNT POSTING. Each labour detail, that makes up an invoice, contains a Labour number and a Department number field. These two fields can be used in combination or by themselves to break the invoice down to allow posting to a variety of GL Sales Accounts. A maximum of 200 combination type records are allowed.

Keep in mind that if you use this method there must be a record for each combination you wish to separate out. You should have one @ record with no labour or department number limit, and a type code of {ALL} to catch odd combinations not defined.

NO BREAK DOWN REQUIRED - ALL INVOICE SALES TO ONE GL ACCOUNT. If you do not need any breakdown, just setup one @ class record, with no DEPT or LABR field setting, just ALL in the "TYPE" field and the Sales Account in the "GL ACCOUNT" field.

Following, are FIELD EXPLANATIONS valid for the @ Class Type Record. All other fields are not used.

TYPE

This field should be left blank except for the one and only @ record which is to direct posting for all labour billing records not defined by any other @ type record; for this one place ALL in this field.

If you place a number here it will override the "DEPT" field when billing invoices are posted.

DEPARTMENT

This field refers to the Payroll Department assigned to the labour details for billing. Use this field alone or in combination with the LABR field, to post appropriate billing details to the GL ACCOUNT field assigned to this type record.

LABOUR

This field refers to the Payroll Labour number assigned to the billing labour record. Use this field alone or in combination with the DEPT field, to post appropriate billing details to the GL ACCOUNT field assigned to this type record.

GL ACCOUNT

Refers to an appropriate GL Sales Account defined in in MENU #2, that all selected labour billing records, for this type record, will be posted to.

"I" CLASS Records

Sales/Expense Account Posting for Invoicing

These kinds of types are entered on the detail lines during Invoice input to define which GL Account the sale or expense amount will be applied when posted.

As a time saving feature the following fields are accessed and assigned when the type is entered into an invoice detail line during Record input.

DESCRIPTION

Will be assigned to the LINE NOTE as long as ** is not an "N". Also helps define the type for viewing and selecting.

**

Except for "N" as stated above this field is assigned to the TAX field to control taxing on these items as follows;

"N" = No tax

"G" = GST only

"H" = HST only

"P" = PST only

UNITS

Will be assigned to the units field of a detail line.

PRICE

For I class records, this field represents the default price associated with this type. It will be assigned to the price on an invoice input detail line, after this type is entered.

"P" CLASS Records

PAYMENT Types for Order Entry Management System

Used in the "Payment TYPE" or "Deposit" type fields of the Invoice input (MENU#14) to indicate description of payment (i.e. Paid in Cash) and the appropriate GL Account for posting.

DESCRIPTION

Will be printed on the invoice if type selected.

GL ACCOUNT

Enter an appropriate asset Account that you wish to post the total of the invoice or deposit to if this type is selected.

"S" CLASS Records

Shipping Description Options for Order Entry Management

This type is accessed during order entry input in MENU #14 against the "Ship Via" field. Use it to speed up input and/or ensure that the order gets shipped in the appropriate method for ongoing suppliers and customers.

DESCRIPTION

This field will be assigned to the "Ship Via" field of the input record if this type is; a) selected from a scan list while on the "Ship Via" field. b) in the "SHP. Type" field of the COA master record prior to assigning the COA# to the invoice input.