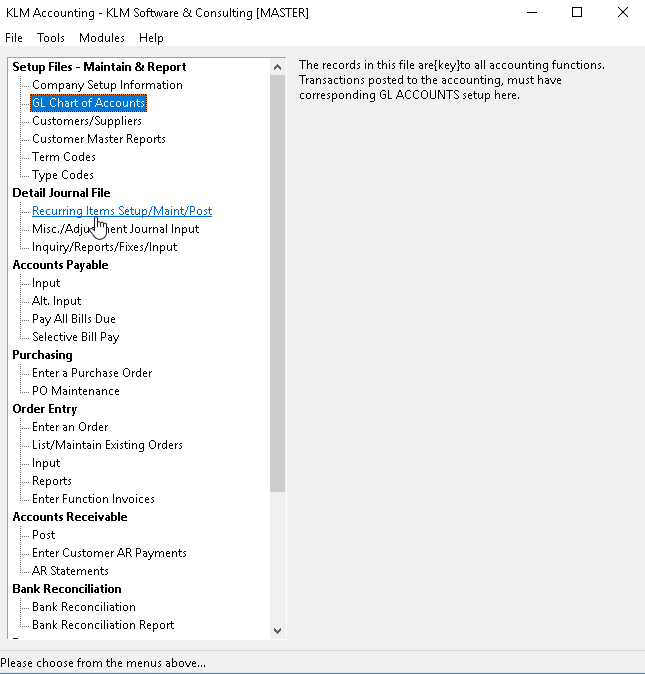

GL Chart Of Accounts

GL CHART OF ACCOUNTS

PURPOSE:

The records in this file are key to all accounting functions. Transactions posted to the accounting, must have corresponding GL ACCOUNTS setup here.

Each ACCOUNT record represents an information category, that will determine how your financial reports will look. The kind and number of ACCOUNTS will be determined by your companies need and variety of transactions.

An accounting background is needed to develop this file from scratch, so KLM Software has provided a basic CHART OF ACCOUNTS that you can add to and manipulate or use as a guide to replace it with your previously developed CHART OF ACCOUNTS.

This file stores a total of all activity for each account, by accounting period (month), for each accounting year. These totals are placed here by Special Routines -> Evaluate/Maintain Detail Journal, for use in printing Financial Statements.

This file holds the opening balances for the year (balance sheet items only) for use in printing the Balance Sheet. The opening balances are placed here by you during setup but will be maintained by Special Routines -> Accounting Year End program each year automatically.

Financial Statement layout, headings, totals, sub-totals, paging and list sequence information is controlled by this file.

WHEN SETTING UP A CHART OF ACCOUNTS FILE - KEEP IN MIND

- If you have more than one Accounting Company each Company MUST have it's own CHART OF ACCOUNTS

- See GL ACCOUNT Number in FIELD DEFINITIONS for important information about how this file is accessed

- There is no limit on the number of GL Account Records

- DO NOT create SUB Accounts for your suppliers and customers. This system uses the Customer number against each journal entry to accomplish this task.

- REQUIRED SETUP - RESERVED GL ACCOUNT The last Balance Sheet Account must be marked for a special purpose, with an N in the +/- Entries field and reference to Current PROFIT(-)/LOSS(+) in[the Description]field. It is used by the Balance Sheet report to position the calculated NET PROFIT total, and must never be used as a posting account.

- CONSOLIDATING GL ACCOUNTS ON INCOME STATEMENTS If the following division breakdown is not required, you can use a similar "." method of defining account numbers to consolidate Income Statement totals. This can be invaluable if you wish to have detailed breakdowns for your own use but less breakdowns for people outside your company, like the bank. If consolidation is selected for the Income Statement all GL Account numbers with the same characters before the "." will be merged as one total.

- DIVISIONS - Separate Income areas within the Company. Use DIVISIONS to be able to keep track of how profitable each department within the company is. Income Statements will then print for each department and/or a consolidated Income Statement for the whole company. Division breakdowns are accomplished by adding a "." followed by department identifier (characters and/or numbers) to all sales and expense accounts (when created) that belong to that department. For example: the GL Account for telephone expense is "730". To create a Division breakdown for our sales and service department, create a GL Account "730.SER" and "730.SAL". Then, you would have to make sure that when the telephone bill is entered, the appropriate amounts are applied to "730.SER" and "730.SAL".

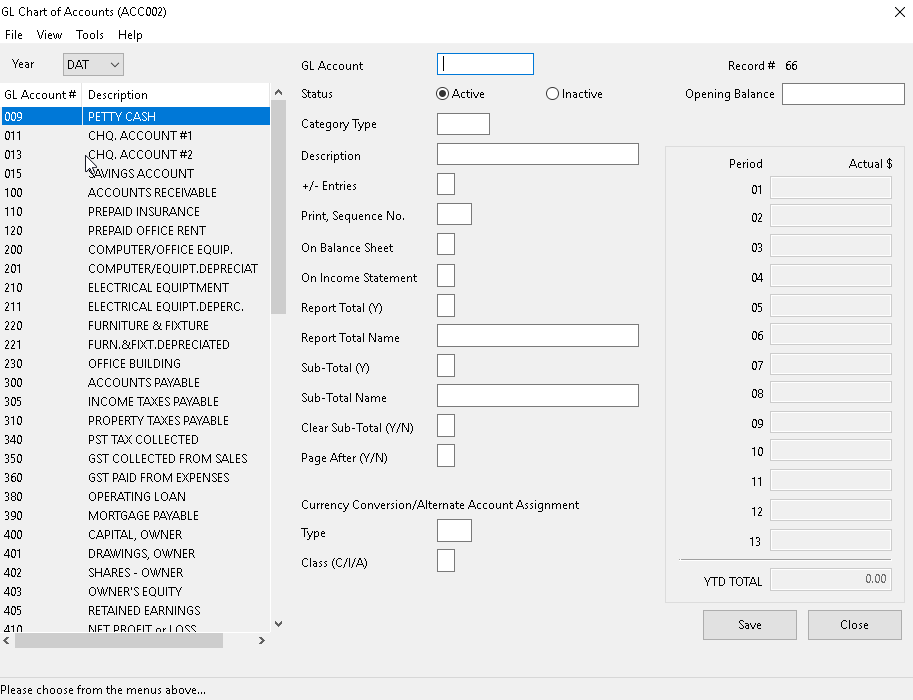

ADDING A GL ACCOUNT Number

1) From the main screen, click on FILE, than select NEW. A blank GL edit screen will appear to the right.

2) Fill in the appropriate fields (see Field Definitions) to the GL Account add screen, then click on SAVE to save the new record.

3) Once saved, you WILL NOT be able to change the GL Account number so assign it carefully. If you do need to change it, delete the old one and create a new one.

MODIFY or DELETE an existing GL ACCOUNT Number

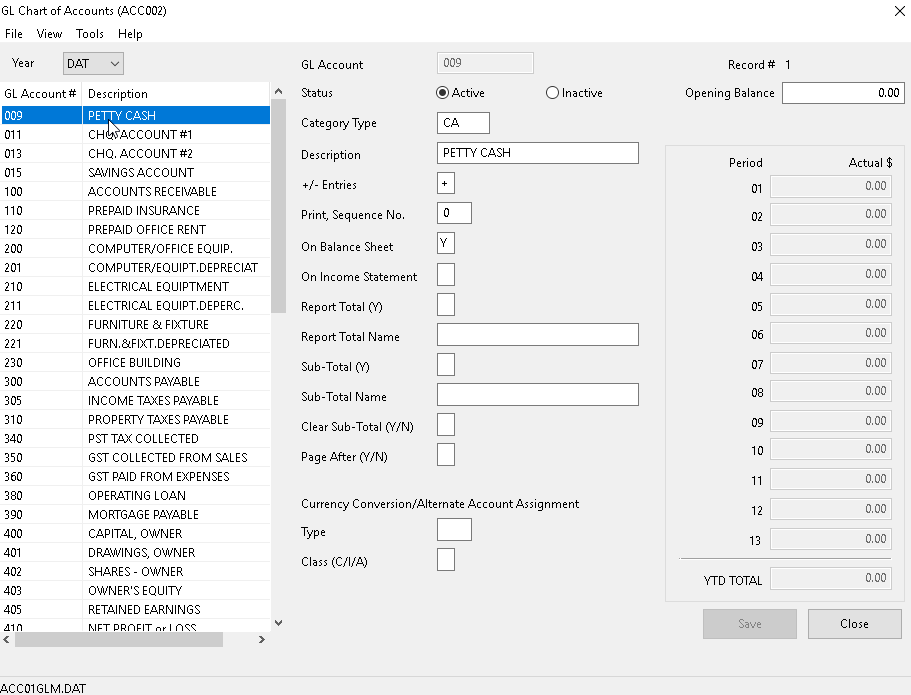

1) From the main screen, select the GL Account Record to update by clicking on it. The record’s details will show to the right.

2) To DELETE an Account, simply make the record you selected, INACTIVE and the program will automatically place a "D" in the STATUS field of the record.

3) Make necessary changes (see Field Definitions) then click on SAVE to save the changes.

LIST GL ACCOUNT FILE

To print a List of GL Accounts, do the following:

1) While in GL Chart Of Accounts, select TOOLS,

2) Then select PRINT FILE LIST. A selection screen File List Report will appear.

3) Select list options then click OK to proceed. A PRINT PREVIEW screen will appear. You can then print the report or exit.

FIELD DEFINITIONS:

Field |

Definition |

GL ACCOUNT |

The GL ACCOUNT number is an{alphanumeric}field (letters and/or numbers) used to{designate the order}to which accounts will appear{on the Financial Statements.}The GL ACCOUNT "2" would appear after the GL ACCOUNT "010" because of the alpha left to right sort. This fact will allow expansion in account groups so you don't have to have lots of leading zeros. For example; to insert an account between 771 and 772 enter 7711. |

STATUS |

Must be A to be considered active by all programs. Enter a D to mark this account for deletion. This is done automatically when you select either ACTIVE or INACTIVE. |

CATEGORY Type |

You must assign an appropriate valid TYPE to the[Category Type] field. All accounts for a specific TYPE must appear next to each other. This field works together with the Transaction Type File (ACCMENU#5) and the Financial Statement Program (MENU#23) to create automatic group headings and totals for all accounts with the same Category Type. If the SUMMARY option is selected for the Income Statement or the Balance Sheet (MENU#23), only the total line for the [Category Type]group of GL Accounts will be shown. |

+/- Entries |

Except for the following item, this field has no effect anywhere in the system. It is a guide for viewing the journal, for those of you who are not to sure of debits(+) and credits(-). If new input to this Account is normally "+" and reversals are "-" then a "+" should be placed hear, otherwise use a "-". |

DESCRIPTION |

This description will appear on various reports and screens to identify this GL Account. |

OPENING Balance |

Reserved for Balance Sheet accounts only, all other entries are ignored. This field will be automatically updated, when the Accounting Year-End options (Menu #31) are run. If you are using this system for the first time, YOU HAVE TO enter these values. The values in this field represent the starting balances prior to day one of your current accounting year. The total of these entries must equal zero. |

PRINT Sequence No. |

Normally the order in which GL Accounts are printed on Financial Statements (MENU #23) is controlled by the GL Account Number and this field is left blank. This is the preferred method. If you wish to change this, a sequence number would have to be placed in each GL Account. The Financial Statement program (MENU #23) would then trigger a sort based on this field to decide the order of printing. |

On BALANCE Sheet |

Indicate to the system that this is a Balance Sheet Account by entering a "Y" in this field, if this is an asset, liability or equity item. A "Y" MUST BE in this or the next field. |

On INCOME Statement |

Indicate to the system that this is an Income Statement Account by entering a "Y" in this field, if this is a revenue or expense item. Also see[On Balance Sheet]and[Category Type]fields. |

REPORT Total (Y) |

Enter "Y" if you want the accumulating report total up to and including this account to print on the appropriate Financial Statement (MENU #23), after this account prints. |

REPORT TOTAL Name |

Enter the Heading you wish to accompany the above total into the Report Total Name]field. |

Sub-TOTAL (Y) |

Enter "Y" if you wish to print the SUB-TOTAL that has been accumulating up to and including this GL Account since the last time it was cleared (or since the beginning of the report if not cleared yet). The SUB-TOTAL will be printed after this Account and any Category Type Totals. |

Sub-TOTAL Name |

Enter the heading to accompany the SUB-TOTAL amount. |

CLEAR Sub-TOTAL (Y/N) |

Enter an "N" if you DO NOT want to clear the SUB-TOTAL after it is printed. Any other entry will cause the SUB-TOTAL to clear. |

PAGE After |

Enter a "Y" to force a page up after this GL Account and any Category Type, Sub-Total or Report Totals have printed on the Income Statement or Balance Sheet. |

TYPE |

a)This field along with the CLASS is used to trigger a currency conversion (Income Statement Accounts only) based on "Rate" defined against this TYPE in the TYPE File (ACCMENU #5). CLASS Must be a C or currency conversion will not work. (See ACCMENU #5 Class "C" functions.) b)If the automatic "EXC" exchange journal entries are being calculated by the KLM System; you can place the currency code (i.e. "US") in the TYPE field to stop it from applying the "EXC" entries to this GL account number. |

PERIOD ACTUAL $ |

Month By Month Journal Activity These thirteen fields are{DISPLAY ONLY}. The dollar amounts represent the total of all journal records for the selected file year by period. These values are maintained by ACCMENU #30 for use in MENU #23. |

YTD TOTAL |

Total activity based on the addition of all the ACTUAL $ values in the above field description. This Total includes the "OPENING BALANCE" field for Balance Sheet Accounts only. |

CHART OF ACCOUNTS - UTILITIES (TOOLS Menu)

In addition to being able to print a listing of the Chart Of Accounts, you can do the following maintenance of this file from this option.

Remove D (Inactive) Status Records

On occasion you may wish to remove inactive (no longer used) GL Account Records. Or GL Account records that have never been used or were created by mistake.

Before doing so, keep in mind.

- Removing records, physically deletes them from the file

- You should NOT remove a record, if you have journal entries applied to it.

To remove records, do the following:

1) While in GL Chart Of Accounts, select TOOLS,

2) Then select REMOVE D STATUS RECORDS. The program will proceed to preform the requested maintenance.

3) Once complete, the message D STATUS RECORDS REMOVAL MAINTENANCE COMPLETE will appear. Click OK to finish the job.

Clear Opening Balances (Field)

There can be instances where you will need to clear (replace with zero) the OPENING BALANCE field for each GL Account record. As you can copy GL Chart Of Accounts from one company to another (to save time during setup), this options saves you the step of clearing said field manually.

NOTE: When running this utility, the program clears that field for ALL records in the current Company's GL Chart Of Accounts file. Be very sure BEFORE running this utility.

To Clear the OPENING Balance field, do the following:

1) While in GL Chart Of Accounts, select TOOLS,

2) Then select CLEAR OPENING BALANCES The following warning message will appear THIS WILL REMOVE ALL OPENING BALANCES FOR ALL GL ACCOUNTS. ARE YOU SURE. Answer YES to start the utility.

3) Once complete, the message BALANCES CLEARED FOR ## RECORDS will appear. Click OK to finish the job.