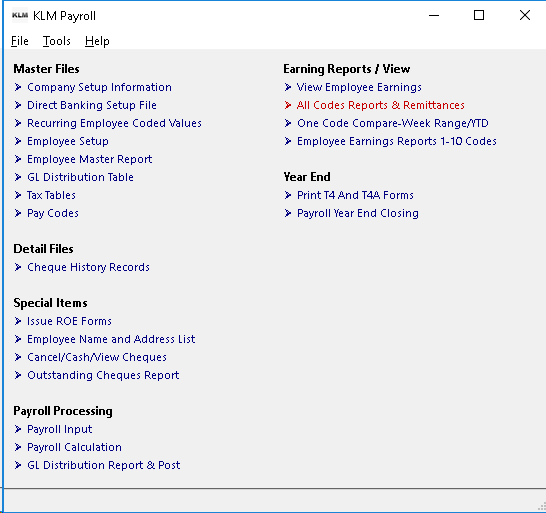

All Pay Codes Report

All Codes Reports & Remittances

Purpose

From this option, you can obtain all the information required by Revenue Canada for Payroll and Employer Health Tax Remittance Reports. You can also run a variety of reports for your own use.

Payroll is usually one of the largest expenses for a company and this allows you to keep track of such items as wage and payroll remittances.

Keep In Mind

You can run reports as many times as you wish. For reports to print the following files must exist:

- A valid COMPANY MASTER in Menu #1.

- Valid EMPLOYEE MASTER records in Menu #5.

- Valid PAY CODES file in Menu #8.

- Existing CHEQUE HISTORY in Menu #9.

Each calendar year has it's own historical data files, you must specify which year you wish information to be retrieved from. The program **ALWAYS **defaults to the current year if no entry is made.

Reports list only those earnings records that are considered active (the earnings record STATUS is NOT an X}. Limitations placed on listing must be met or data is not printed

When reports are run, all PAY CODES to which dollar amounts can be applied will be shown on the report. Only detailed reports show the amounts broken down by employee.

Listing Cheque History Information

To list existing Cheque History information, do the following:

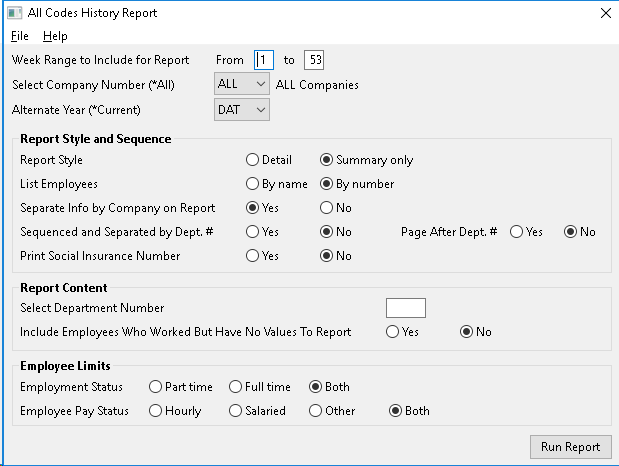

1) At the KLM Payroll System Selection Menu, select All Codes Reports & Remittances. The Year To Date Summary screen will appear.

2) While at the Year To Date Earnings Summary Screen, if you leave the defaults in place and RUN the report, you will get a Year-To-Date report, for the current year, for ALL employees in all companies, in summary format.

Report Options

You can use the report selections provided to customize your own reports.

DATA LIMITS

Include the calendar year, the company for which you are reporting and the PAY WEEK range (1 to 53).

REPORT STYLE AND SEQUENCE

Selections determine how much information is listed AND SEQUENCE of data (in what order it is listed).

- Report Style limits you to 2 choices: **SUMMARY **which prints 1 line of data per limit, or DETAIL printing 1 line per employee.

- Report Sequence is limited to Employee NAME or NUMBER order. Only lists in DETAIL can be listed in NAME order.

- Separate by Company allows you to print all companies, one after the other.

- Separate by Department allows you to print all departments, one after the other.

REPORT CONTENT

Separate by Company provide you with a means to limit what information is printed, by excluding records that don't contain the appropriate information.

- Selecting a specific DEPARTMENT number limits the Employees listed to the Master records that match that Department.

- You can also choose to report on employees who are active but may not have records within the range of records specified.

EMPLOYEE LIMITS

These two prompts allow you limit the report to certain kinds of Employees.

- Employment type includes those who are FULL or PART Time or BOTH

- Employee Pay for those who are SALARY or HOURLY or Other or BOTH

In both cases, this is determined by the contents of the Employee's Master record

Problems Listing Cheque History Information

EMPLOYEE records are sorted by both EMPLOYEE NAME & NUMBER. Saving you time, by speeding up record access when printing.

If any of the following occurs when you are trying to list or retrieve records:

- Records are missing; not on reports etc.

- Report listings appear to be repeating themselves; listing the same records over & over.

- Reports stop part way through listing.

If the sorting function of this option has been disrupted.

To reset the SORTING functions, do the following:

a) If asking for your listings by **Employee Name **sequence, try asking for the same report by Employee Number.

b) If the report runs without incident, the error lays in the EMPLOYEE NAME SORT function. See EMPLOYEE MASTER UTILITIES for instructions on re-setting name sequence.

OR

1) If the report is still in error, then the problem lays with either a) limits placed upon the report or b) EMPLOYEE NUMBER SORT function.

2) For situation a) verify that the information exists Verify the contents of Menus 1, 5 and 9.

OR

2) For situation b) do an EMPLOYEE NUMBER SORT. See EMPLOYEE MASTER UTILITIES for instructions on re-setting the number sequence.

Government Remittance Reports

You are required by Canadian law to withhold Income Tax, Canada/Quebec Pension and UIC deductions taken from each employee. These deductions along with your company's portions for CPP/QPP and EIC are submitted to Revenue Canada on a regular basis. Revenue Canada will set the time based on the size of your work force.

Depending upon the type of business you run you will also have to make payments to the Workman's Compensation Board. Also most provinces have some form of Health insurance that you are required to pay into in some form of payroll tax.

You must know which pay week ranges fall in each calendar month. Use the Week Ending Dates information to determine this.

If all payroll amounts were properly posted to the Accounting section using the GL Distribution Report & Post, the correct dollar amounts have already be applied to the appropriate GL Liability Accounts. These reports can be used as a means of verifying the accounting figures.

EIC/CPP/QPP/EHT Tax

A remittance report is extracted by specifying a summary report for the required week range. The Canadian government requires you summit a number of reports for remitting various payroll deductions (i.e. Tax, CPP, EIC, & EHT).

When remitting CPP/QPP and EIC, remember that along with the employee's portion, your company MUST also remit an amount. Be sure to use the TOTAL remittance figure for these items. Company remittance rates for UIC and EHT amounts are stored in the Company Master (Menu #1). It is your responsibility to make certain these rates are correct.

T4 Reports

When running your T4's, do a summary report for the entire year, as a comparison to the final summary produced by the T4's Report. Since T4's print in name order, or a detail report, in Employee Name order.