Record-Of-Employment

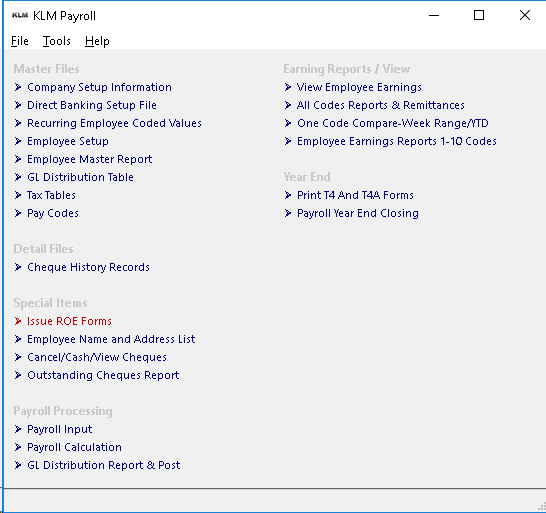

ISSUE AN ROE FORM

PURPOSE

Employment and Immigration Canada requires the employer, to submit a ROE form for any employee you terminate. This option will print, in report format, Record Of Employment information, for one or more employees, depending upon the prompts selected.

In addition to providing you with a paper copy (for your records), the program will produce an electronic file (in XML format) for submission to Employment and Immigration Canada.

Even if you choose not to submit the XMF file, you can still use the report's information, to assist you in filling out the Employment and Immigration Canada's online Record Of Employment form(s).

In either case, you will require a valid Web Access code for submitting any information online. Contact Employment and Immigration Canada directly to acquire said code.

Employment and Immigration Canada website:

For filing ROEs online:

https://www.canada.ca/en/employment-social-development/programs/ei/ei-list/ei-roe/roe-web.html

REQUIREMENTS

Before an ROE can be issued for any employee, ALL of the following MUST be correct;

- Valid Company Master file

- Valid Employee Master record

- Cheque History records for the current year (for any employee requiring an ROE)

- Cheque History records for the prior year (even if they did not work in that year)

- Valid week ending dates file for both current and prior year.

GENERAL INFORMATION

Working backwards, from the date of termination, the program lists the last 20 consecutive weeks of work (last 20 pay periods). If your payroll is run on a bi-weekly basis, the program lists the last 10 pay periods.

The program DOES NOT re-calculated the Insurable Earnings for the data it reports upon. Insurable Earnings are calculated at the time the payroll is run. See Pay Code I for Insurable Earnings.

Along with the insurable earnings being accurate, the WEEK # and TOTAL WEEKS worked MUST be correct. If payroll is bi-weekly, you should be splitting earnings between the appropriate weeks.

The program requires 53 weeks of consecutive earnings in order to properly issue an ROE, regardless of whether an employee worked at all in the prior year.

When a report is issued for an employee, the LAST ROE REPORTED DATE field of the Employee's Master record is updated with the most current pay week ending date. This is done to allow multiple ROEs should an employee stop than restart working for you (as in temporary lay offs).

Because this program creates both a printed report and an actual data file, some prompts must be filled in, as they are required as part of the electronic file (such as contact information). You will prompted, if any information is missing. The program will not proceed until all required fields have been filled in.

As the employee's last pay may contain extra monies for items such as bonus or severance pay, make note of these, as they will have to be reported on the ROE.

While the program will automatically record certain types of earnings (such as vacation pay), the free format of KLM's Payroll software prevents us from automatically recording certain amounts ( such as severance pay), as not every company uses the same Pay Codes for the same earning types.

If running ROE forms for more than one company, be sure to select and run each company separately, so that the XML file is accurate. Since each payroll company will have it's own unique Business Number (for Payroll remittances reporting), each XML file must reflect this.

OPERATING INSTRUCTIONS

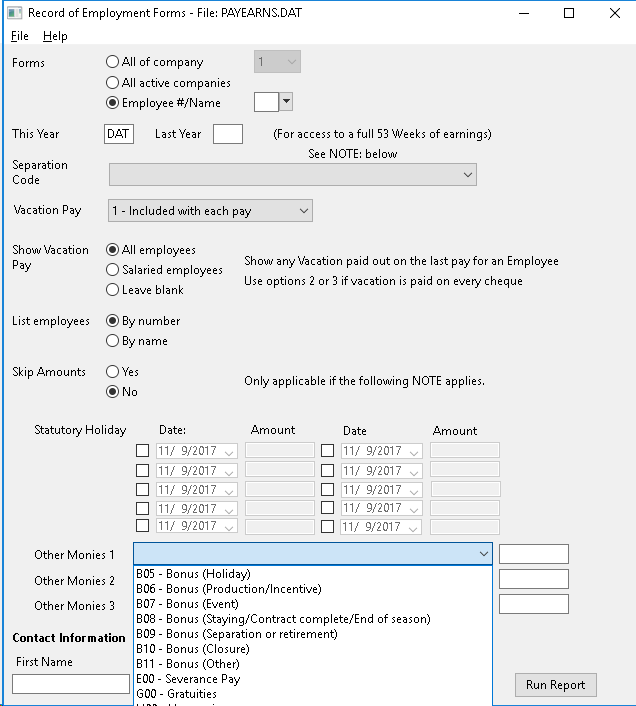

1) Select Option #12 Print ROE Form from the Main Menu. In order for the ROE's to print correctly all of the following prompts must be answered correctly.

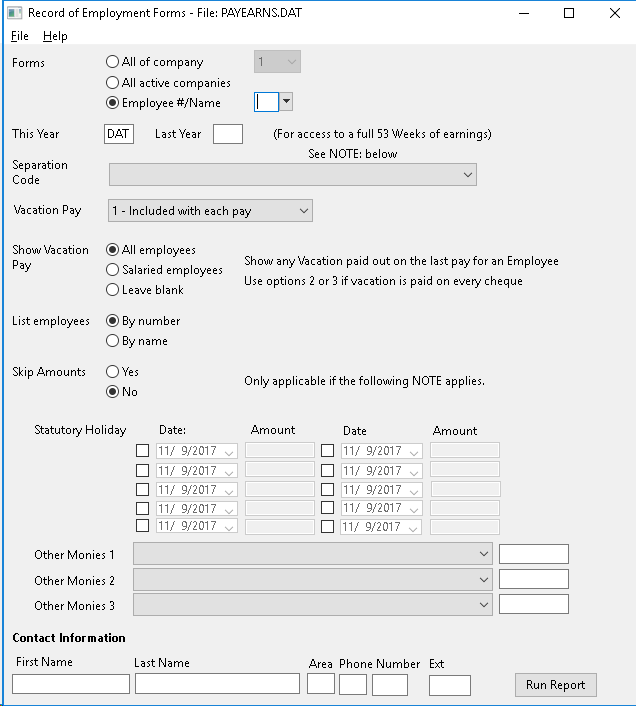

2) Answer each of the screen prompts.

FORMS: Which company and / or employees to print. You have 3 choices:

- All Of Company, select ONE company to print

- All Active Companies, prints ROE information for ALL active companies employees. Note, you can not do this option if you intend to submit the XML data file.

- Employee #/Name, prints information for only the employee you selected. Be sure to "rename" the corresponding XML file, as it will be overwritten when a new employee is selected.

THIS YEAR / LAST Year: Which Earnings History files will be used. There are two fields:

- The program automatically puts the DAT in for the current year's data files.

- The LAST year will usually be the prior year's data file. (i.e. if this year is 2017, last year will be 2016 represented as 16). The program will automatically fill in this field, with the prior calendar year's number.

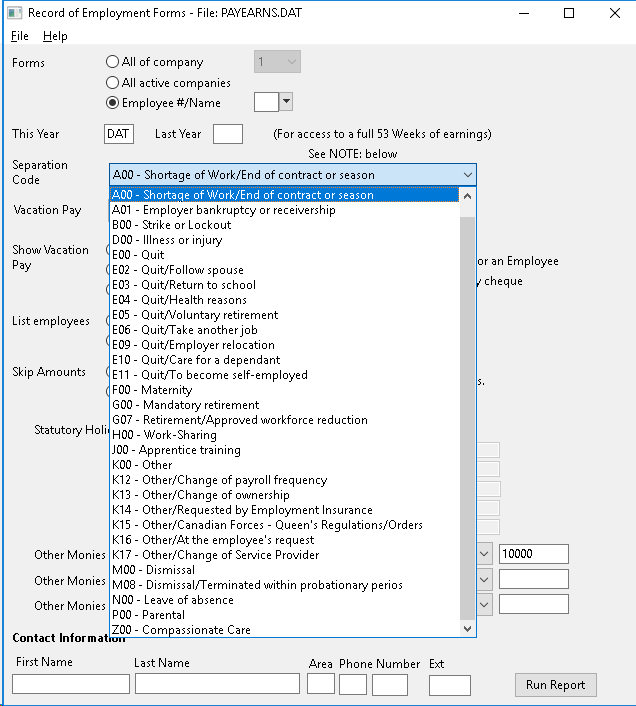

SEPARATION CODE The reason someone is no longer being employed by your company. You must answer this prompt.

- Select from the list provided. Each selection contains a 3 character code followed by an explanation.

- This information will print on the ROE report and be placed in the Termination field in the Employee's Master Record (see Pay #5).

- You will be prompted, if this field is not filled out.

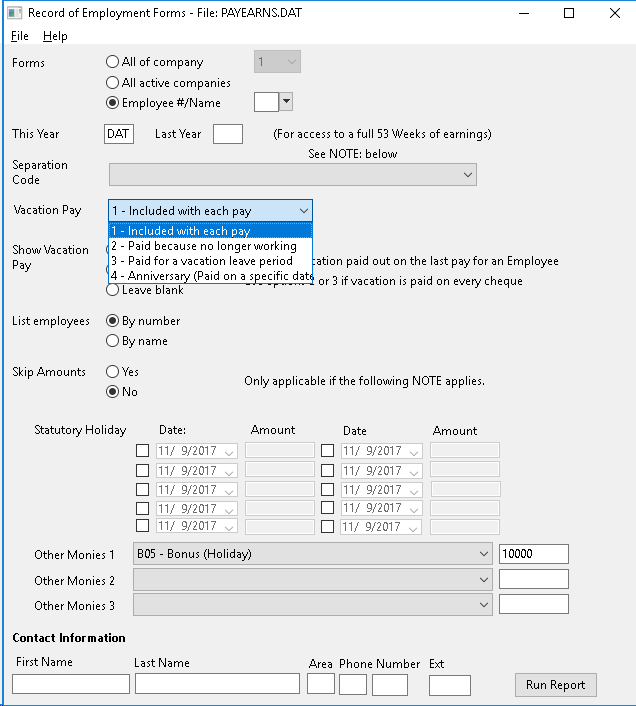

VACATION PAY You must indicate how and when vacation pay is issued (paid) to said employee (or employees).

- You have 4 options to choose from. Option 1 assumes you pay vacation pay as part of each payroll.

- Options 2, 3 & 4 assume that vacation pay is paid only at specific times (it is accrued).

- In most cases, any vacation pay still owing should be issued as part of the last pay cheque.

- The program will look for this amount on the last pay and print it accordingly (vacation pay amount must be applied against pay code V for program to work properly).

SHOW BLOCK (for BLOCK 17 on ROE form): Determines when and whether vacation pay was issued. There are 3 options.

- The default of All Employees for this option assumes that you wish the Vacation pay amount (which should have been issued on their last pay cheque) to be printed in Box #17 of the ROE form.

- You can limit the function to salaried employees only (any employee with a PAY TYPE of{S})

- Or leave simply leave BLOCK 17 blank.

LIST EMPLOYEES: If printing multiple forms, in what order do you want employees to be listed. You have 2 choices:

- The default is to print by Employee Number or in Employee number order

- You can choice to print employees in Name order instead of number.

STATUTORY HOLIDAYS Use this section to record any dollar amounts paid to the employee for holidays that may have occurred during their last pay period.

- You can enter up to 10 dollar amounts for this purpose.

- The corresponding dates are optional but if entered they will be included in the XML data file. The dates entered should correspond to the holiday which you are pay for (i. e. for Canada Day, select 01/07/2017)

- Use the Date Picker utility, to help in selecting dates.

OTHER MONIES 1 - 2 - 3: Use these 3 sections to record any additional monies received by the employee as part of their separation package (such as receipt of severance pay).

- You must select a type of payment from the list provided, than the dollar amount the person received.

- You can record up to 3 separate types of payments.

- This information will be placed int he XML file.

CONTACT INFO. This information is placed in the XML file. It should contain the name and phone number of whomever filled out this ROE.

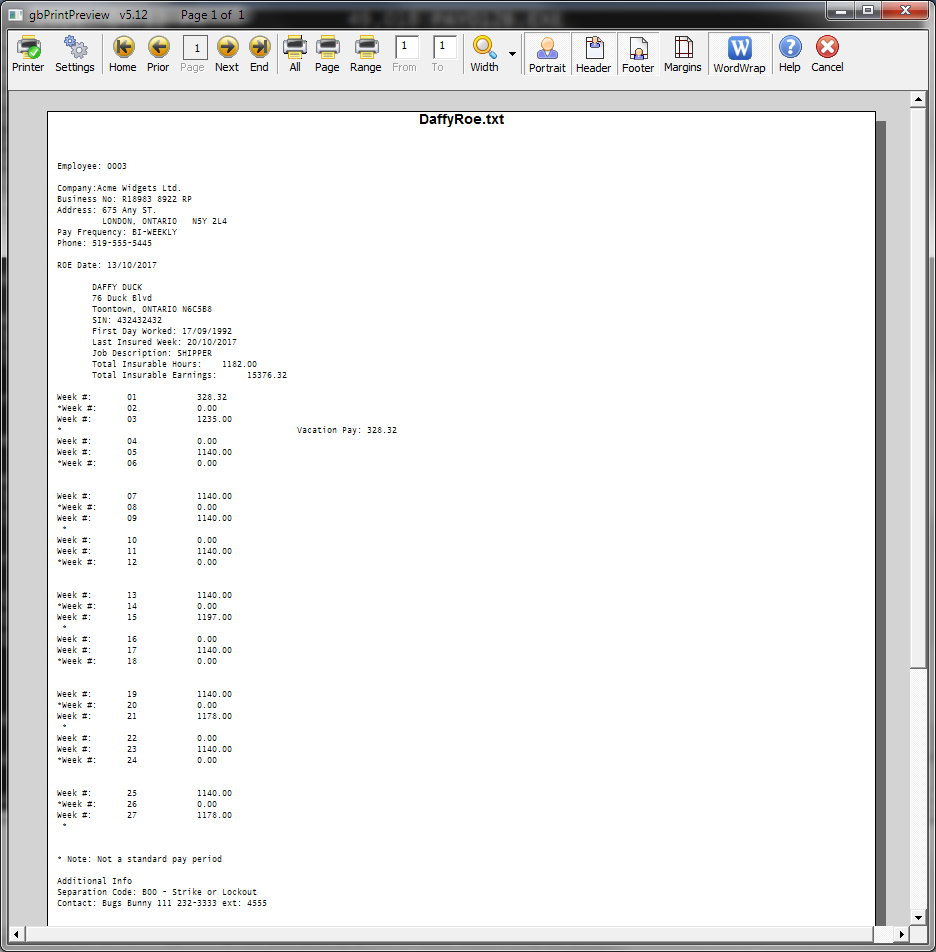

3) Once all prompts have been answered, click on RUN REPORT to begin the printing process. When done, a Print Preview screen containing said report will appear once ALL processing has been done.

4) Once you have printed the report (one page per each employee), you can either print more ROEs or exit said option. If you plan on submitting the XML data file, be sure to rename it before issuing new ROEs, as the file will be overwritten with the latest information.

NOTE: The XML file is stored in the same directory (folder) as your other data files. It is called ROE.XML and can be renamed if need be. Be careful when renaming as the XML extension must be kept.

The ROE program will display this report whether XML will be uploaded or not. If the data will be entered into the CRA ROE Web page use the data from this report.

COMMON PROBLEMS - When Issuing ROE's

If an ROE does not print or the results are not accurate, any number of data files can be in error. You should check all of the following items:

- Company Master - Correct indicators for PAY CODES and WEEK WEEK ENDING DATES files. Correct PAY PERIOD.

- Employee Master - Field LAST ROE REPORTED DATE SHOULD BE blank or contain an appropriate date.

- Week-Ending Dates - For both years, must be correct and can not overlap.

- EARNINGS RECORDS - For both years, should be verified in Menu #9 Cheque History Records for the appropriate weeks and earnings. List earnings for both years in Menu #23 View Employee Earnings to test links. Use utilities in TOOLS Menu to fix links.