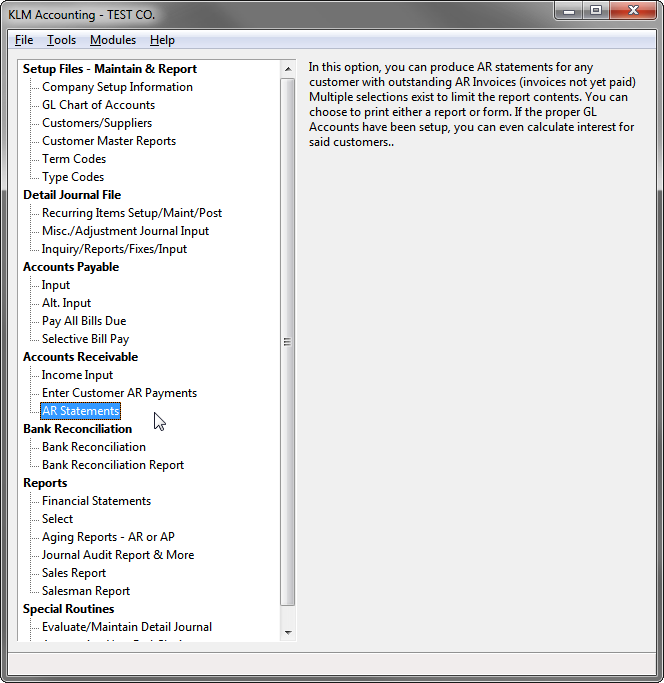

Accounting-AR-Statements

AR STATEMENTS

PURPOSE:

This option allows you to print statements for clients who have overdue invoices owing. As well, interest can be calculated against any overdue invoices and the appropriate journal entries for the interest amounts created. Any interest calculated is printed on the statement against the appropriate invoice.

REQUIREMENTS:

Statements will not print unless the following files exist:

- A valid Company Master File

- Valid GL Chart Of Accounts File

- Valid COA (Customer) File

- Valid Transaction TYPE File

- Outstanding AR Detail Journal Entries for the period in question.

Any information you have entered must have already been posted using Evaluate/Maintain Detail Journal menu, before this program will access the information. You will be prompted if not all Detail Journal records have been properly "linked and posted" before hand.

If you do choose to have the program calculate interest on overdue AR invoices, be sure to run both an outstanding items report as well as actual statements.

Statements will print on plain paper. Custom forms can be designed. Contact KLM Software for further details.

AR STATEMENTS SCREEN

Follow the steps below to produce a detail journal report.

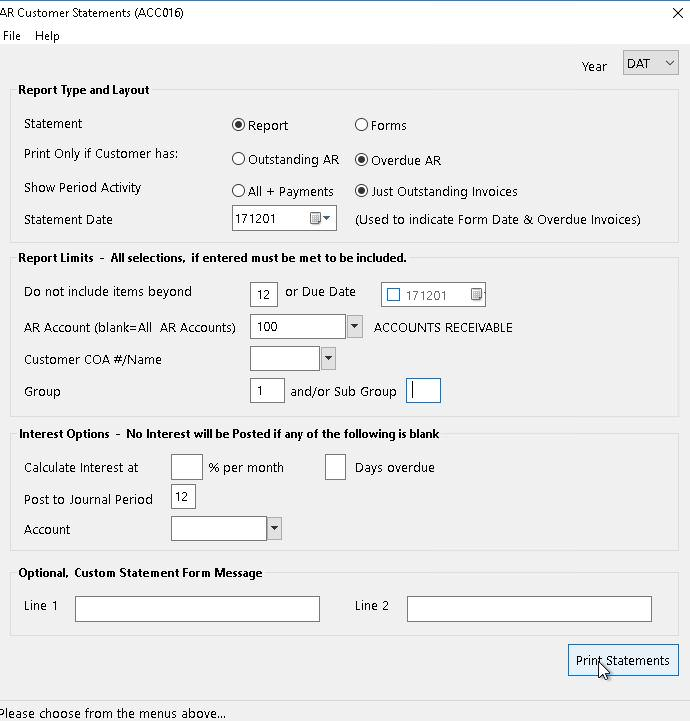

1) Customize the report by filling in the following prompts:

2) Once all options have been selected, click on the RUN REPORT button. A Print Preview screen for said report will appear. You can choose to either print the report or close the Window and select another report.

Report Selection Prompts:

Year: Enter the year to access the appropriate detail journal file. Year "DAT" always represents the current year.

Report Type & Layout options:

Statement: Select either Report or Form. The report option prints a listing of all outstanding items, while the form option prints all outstanding items in a Statement format (one page/form per AR customer).

Show Period Activity: The default only shows outstanding AR invoices while the All + Payments options shows all activity (AR Invoices) for each customer.

Statement Date: The Statement Date is used to determine which Invoices are overdue by comparing the date entered to the Due the Due Date of the original Invoices.

Report Limits:

Don Not Included Items Beyond: Gives yo a choice of limiting the records selected to a specific Accounting Period or Due Date. If selected, only those items that meet the limit will be included.

AR Account: Defaults to your main GL Account for AR. Takes this information from the default listed in your Company Setup Information file.

COA #/Name: Limits the amounts being printed to a specific COA (Customer/Supplier).

Group/Sub-group: Limits the amounts being printed to a specific COA Group and/or Sub-group. This information must have been entered in the appropriate fields within a Customer/Supplier's Master record.

Interest Options:

Calculate Interest: If you choose to include interest owing on outstanding AR Invoices, you can select the rate at which to calculate it (the % percentage) and the number of days overdue an item must be before interest is applied.

Post TO Period: Enter a valid accounting period to post any detail journal records generated, when interest is calculated.

GL Account: To apply the actual interest amount to. The program will automatically create the off-set enter and apply it to the AR GL Account.

Optional: Custom Statement

Line 1 / 2: The program allows printing of lines of notes on each customer statement. The same message will appear on all statements, so keep it general.