Accounting Year End

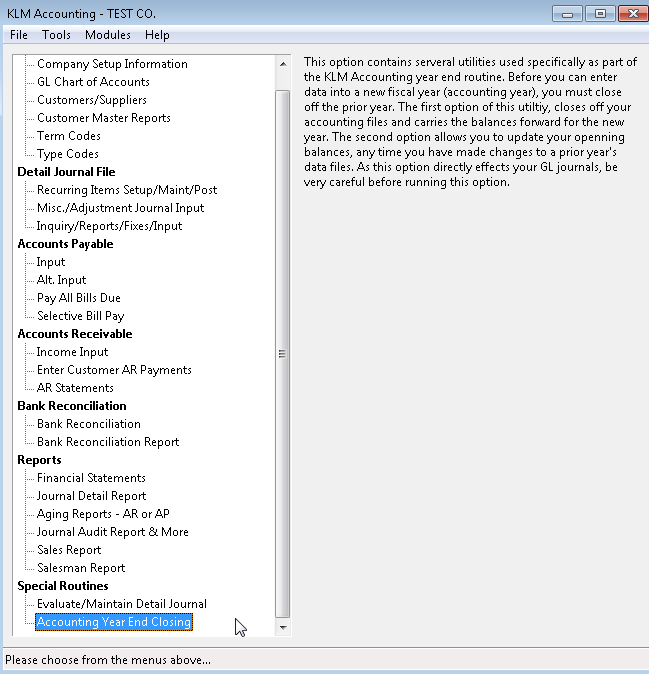

ACCOUNTING YEAR END CLOSING

This program provides a variety of Accounting year end options. Each option is explained separately. Please read each section carefully before running the option as there are serious repercussions if run inappropriately.

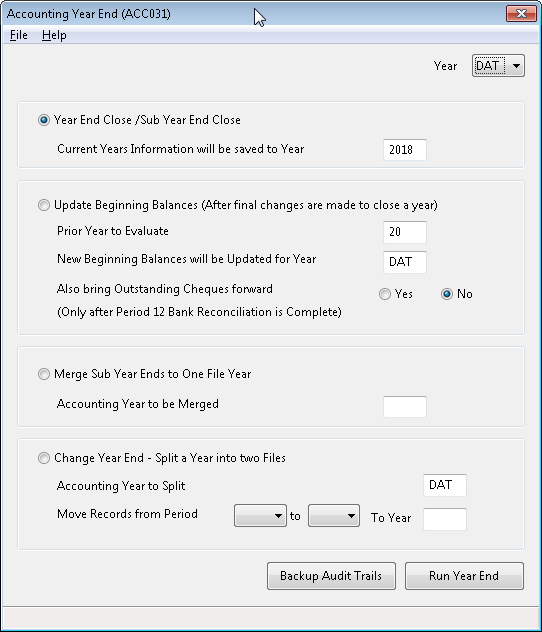

YEAR END CLOSE

Never run a year end for a company more than once per year without the appropriate backup being recovered.

Never run a year end after data input has begun for the new year; consult with KLM about alternative year end methods.

STEPS TO FOLLOW

a) Do a data backup before you begin. If this procedure is interrupted before it has a chance to complete you will need

to recover this backup and start all over.

b) Select the appropriate company number if you have more than one company. You will need to repeat these steps for each company you need to close.

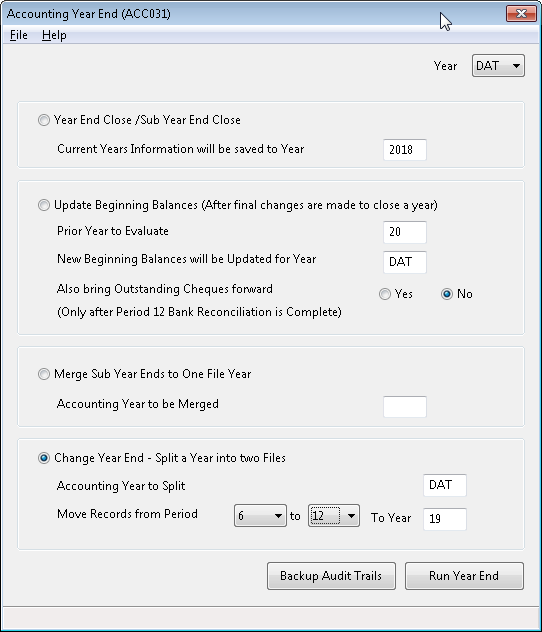

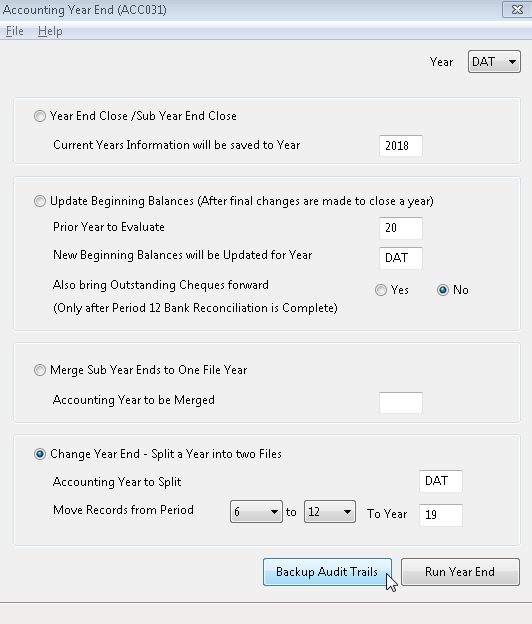

c) Click the Radio Button for "Year End Close/Sub Year End Close

Make sure you select the appropriate YEAR number. If your year ends April 30th 2018, the year you select, must be 2018. The program will produce a warning message if the YEAR you select already exists for the select company.

Sub Year Ends|are created by running this procedure at regular intervals throughout the year. YEAR numbers must be entered with a common YEAR number followed by a letter, ie 18a, 18b,...

Sub year-ends should be run if you want to do a regular month end.

Click "Run Year End" to begin.

d) If the program completes successfully a Message Box stating "Maintenance Complete" will be displayed.

If you do not get the above screen, something has gone wrong and the backup you made in the beginning may be needed. Call KLM Software for further instructions, please have ready the error(s) message that would have appeared on the screen.

e) Once completed successfully backup the YEAR using "Tools -> Backup" from the Main Menu

This backup should be kept for historical purposes for 7 years. If you make any changes or additions to this YEAR, be sure to update this backup.

f) Your current years DATA files have been reset and should also be backed up.

KEEP IN MIND

- All companies must run a year end close at the end of period 12 which marks the end of their FISCAL YEAR.Fiscal years are 12 month-periods long but do not always fall on December 31st as payroll year ends must.

- There is no need to wait for all transactions to be entered before you close a year. This system provides for the fact, that you will need to make some final adjustments to a prior year before you are finished with it. Additions to, and reporting for, a YEAR that has been closed,|can be done through the use of the alternate YEAR field in most input and report programs. Also see UPDATE BEGINNING BALANCES

RESULTS - TASKS PERFORMED BY THIS OPTION

- Renames the current years detail journal and its support files to the YEAR (yr) number you select, as follows;

[File Name ][New File ][Accessed through Menu]

ACC01GL.DAT ACC01GL.yr

ACC01PRD.DAT ACC01PRD.yr

ACC01GLM.DAT ACC01GLM.yr

ACC01GLT.DAT ACC01GLT.yr

ACC01DES.DAT ACC01DES.yr

ACC01CUS.DAT ACC01CUS.yr

- Creates a new set, of the above files, for the current year based on the information that must be carried over into the

new current year;

* Balance sheet Account (ie Bank, AP, AR...) opening balances are set to closing values from the YEAR ending.

* The Retained Earnings (Company profit history to date) account is adjusted to reflect the addition of net profit

for the YEAR closing. The current years profit is set to zero.

* All outstanding AR and AP detail Journal records are transferred to the NEW years journal file. They are assigned

against PERIOD ZERO. This will have NO effect on the journal for the new year, but will be picked up by the programs that require this information (AR and AP functions).

ALL AP/AR zero period detail journal records should add up to the opening balance total against the appropriate

AP/AR GL Account Master record. If not, your balance sheet will no match your aging reports.

WHAT TO DO IF YOU NEED TO MAKE CHANGES TO A CLOSED YEAR

(Update Beginning Balances)

Information can be posted to a YEAR that has been closed, from most Menu options, by changing the alternate YEAR field. This will cause all journal entries generated by that menu option to post to the data YEAR selected instead of the current year.

However you will need to complete the following steps, to ensure that these changes, are applied properly to the system and their effect on the opening balances of the current year.

Note: Never change or add journal records in a YEAR that has already been submitted to the government, unless it is

to bring that YEAR in line with what was submitted.

STEPS TO FOLLOW

To clarify these steps, assume that your current year is 2018 and the year end closed was run for YEAR=17 against Company 01; and you now need to enter some adjustments to year 17.

These steps can be repeated as many times as needed.

a) Transactions for the prior year 17, must be entered or altered using the appropriate menu option you would normally use for that type of transaction, with one difference; you must change the YEAR field from "DAT" to "97 " and the period to 12 or 13 in most cases.

b) Click the Radio Button for "Year End Close/Sub Year End Close". Be sure to enter the appropriate alternate YEAR, which in this case is 17.

c) Backup the prior year using Tools -> Backup from the Main Menu

d) Click the Radio Button "Update Beginning Balances"

Make sure to enter the appropriate|Prior YEAR to Evaluate which in this case is 17

The New Beginning Balances will be updated for YEAR -> DAT should not be changed except in unusual cases. "DAT" represents the current ongoing YEAR, which is the default for all programs.

Bring Outstanding CHEQUES forward (Y or N) is optional but must only be selected once per year under the right

conditions; After the period 12 bank Reconciliation has been cmpleted for the prior YEAR (in this case 17

Two other options exist inside this function an are triggered with; (only run these under advice from KLM)

"I" to bring last years AR interest forward and

"S" to bring last years journal records forward that a match a select TranDate Range/Period/TransType.

KEEP IN MIND

If completed successfully the opening balances of the GL ACCOUNT Master file will have been reset with the results of

the changes made to the prior YEAR (in this case YEAR 17).

Because the current years data files have been affected by running this option do a Data Backup now or at the end of your day on your daily backup disks.

To print a report of these opening balances and to verify that they do balance, it is a good idea to run a Balance Sheet for the current YEAR.

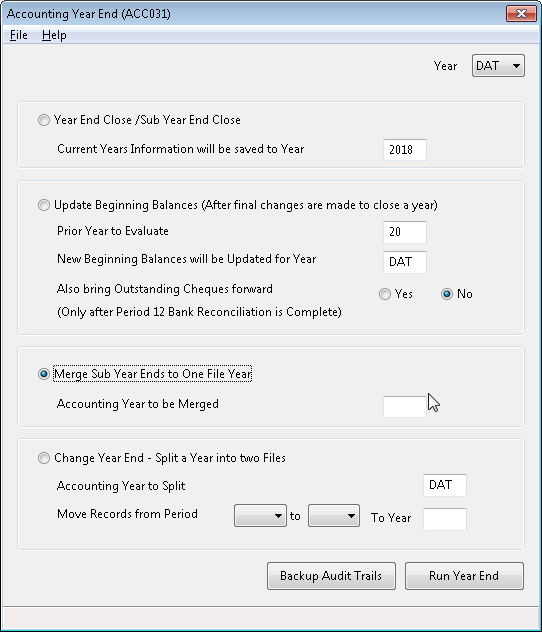

MERGE SUB YEAR ENDS TO ONE FILE YEAR

If you have multiple data files, due to the running of Sub-Year Ends in Option 1, you can merge these files together using this option.

Just enter the YEAR number (ie 97) and the program will search and merge together the YEARs starting at 17a, then 17b,.... it will stop when YEAR "97z" is reached or no file exists for the next YEAR in sequence. The merged years will be deleted once they are merged into the one new YEAR file.

BEFORE RUNNING THE MERGE ROUTINE be sure that all journal records have been linked and posted for each YEAR

Also backup of each sub year using|F7|just in case you have any problems.

AFTER MERGING THE SUB YEAR FILES perform the following:

a) Run a completely re-link for the YEAR number selected for the merge.

b) Do a Backup for the YEAR selected for the merge. The backups done before the merge are no longer needed.

c) Optional. You can run various reports (ie. AR Aging Balance Sheets etc.) to verify that the new created

accounting year contains ALL the necessary entries.

If you verify your information, be sure to have valid reports before the merge to use as comparisons.

Change Year End - Split a Year into two Files

This option can be used to fix the journal if you forget to run your year end, and records for both years are in the same

journal file YEAR.

You will first need to isolate the records by period number as this is used to decide which records will be removed to the new YEAR file and which will remain.

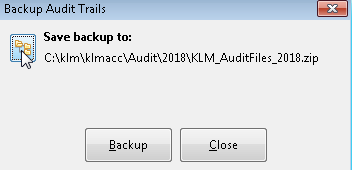

BACKUP AUDIT TRAILS

In KLM Accounting all activities that post to the General Ledger are logged with time, ID of the user and what changes were made. Over the period of a year there will be many files in this folder. (KLM Install folder/audit).

The usual time to archive a year of audit files would be at the end of the year.

Procedure:

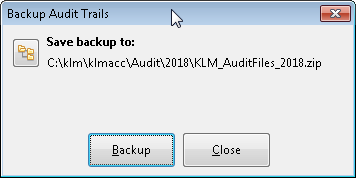

Click the Button "Backup Audit Trails"

The default is to create a folder with the current year in the installation folder of KLM. All audit files that end in the year defined in the "Year End Close/Sub Year End Close" section will be included in the zip file.

Example: If 2018 is the year entered the audit files for 2018 will be saved.

The default location of the zip file can be changed. Click on the folder Icon to save to an alternate location: